Here’s A Quick Way To Solve A Info About How To Sell Bad Debt

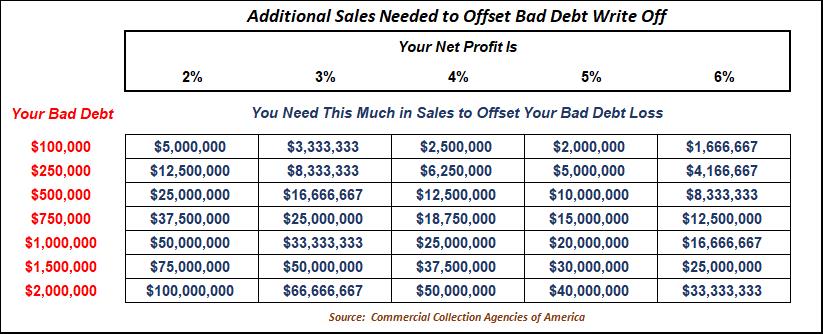

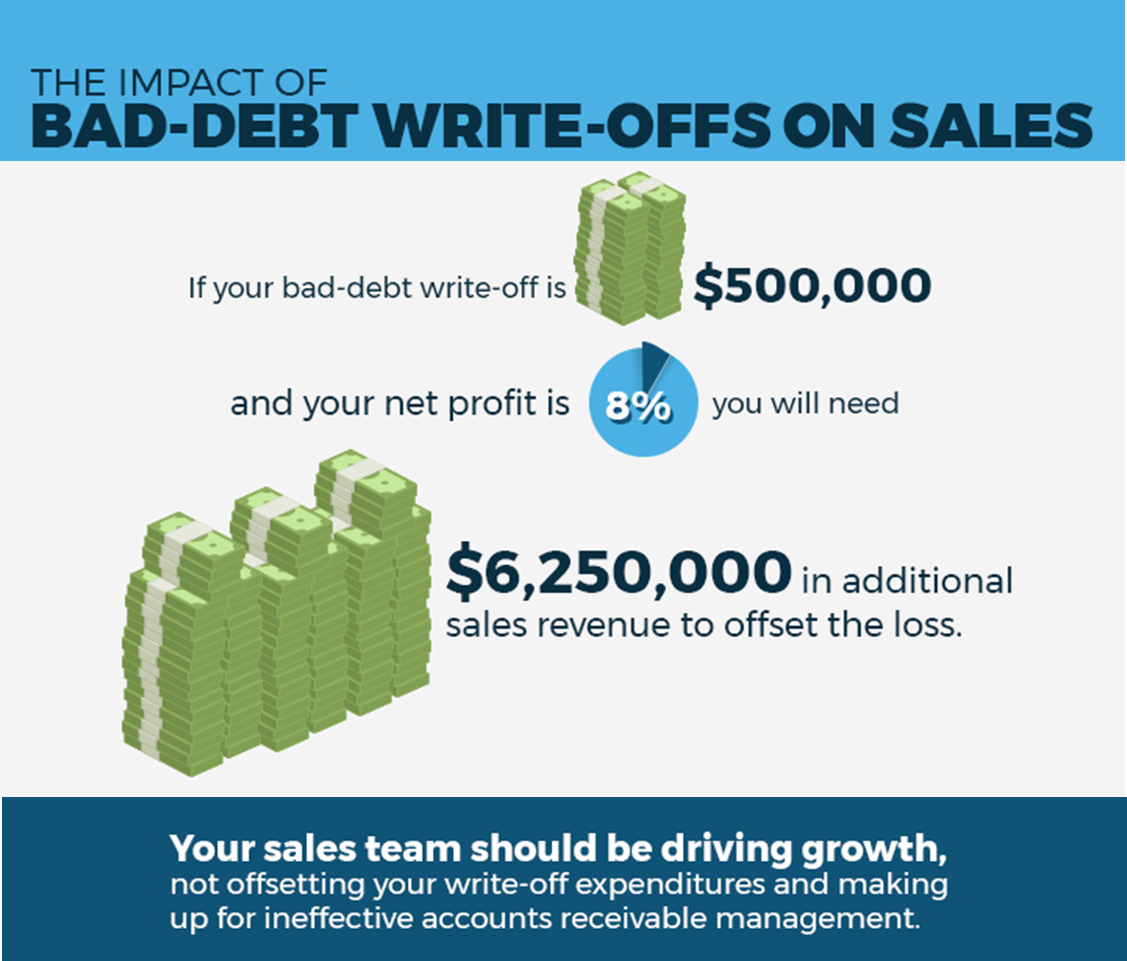

Buying bad debt can be lucrative, depending upon the age of the debt and if the total debt incurred as well as penalties and interest can be secured.

How to sell bad debt. Establish an internal team to handle it. Up to 25% cash back if you're delinquent on one of your debts, the creditor might sell that debt to a debt buyer. a debt buyer is different than a collection agency. When a debt has been purchased in full by a collection agency, the new account owner (the collector).

In the second case the creditor agrees to sell certain delinquent accounts to the debt buyer at an agreed price, prior to the deal;. Your original creditor should let you know when they sell your debt. Get your free quote now!

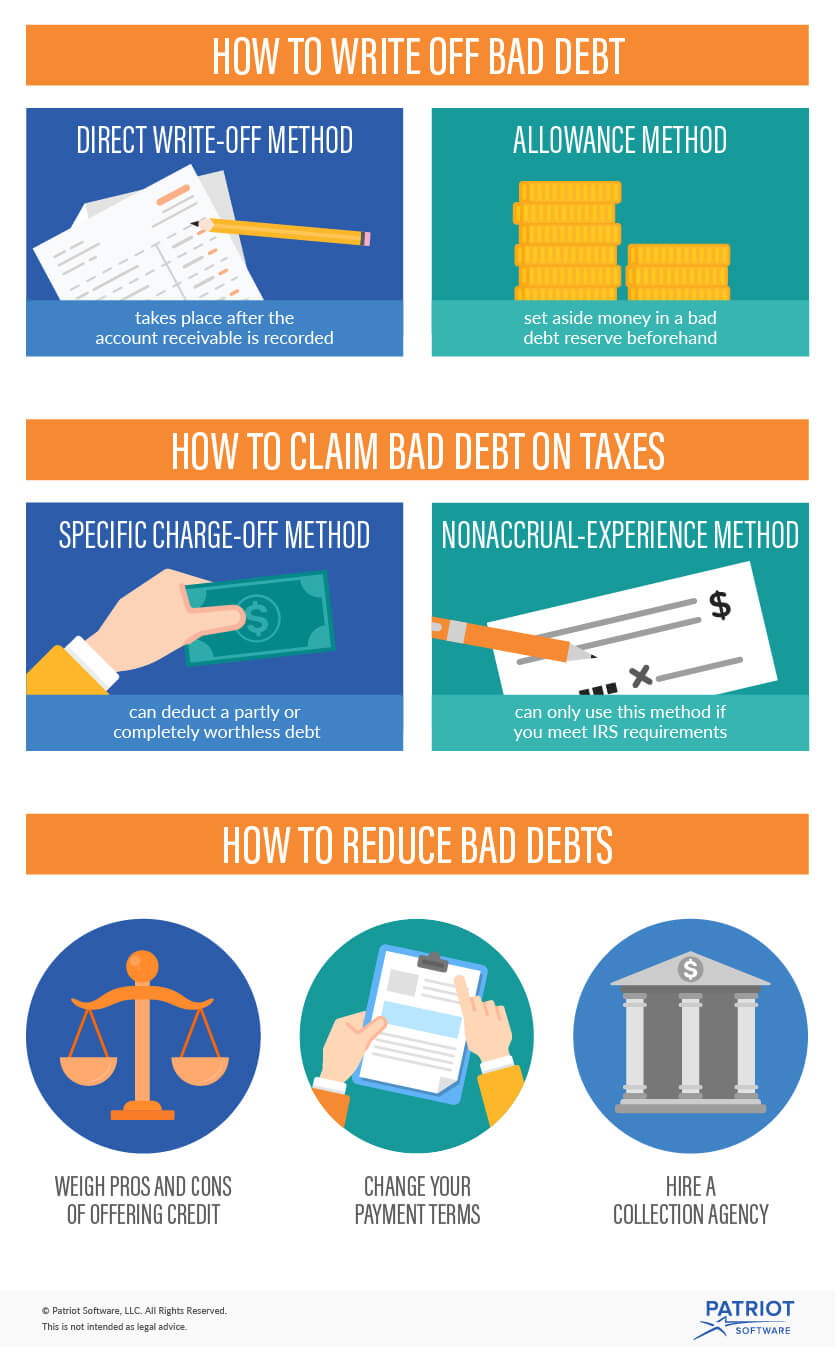

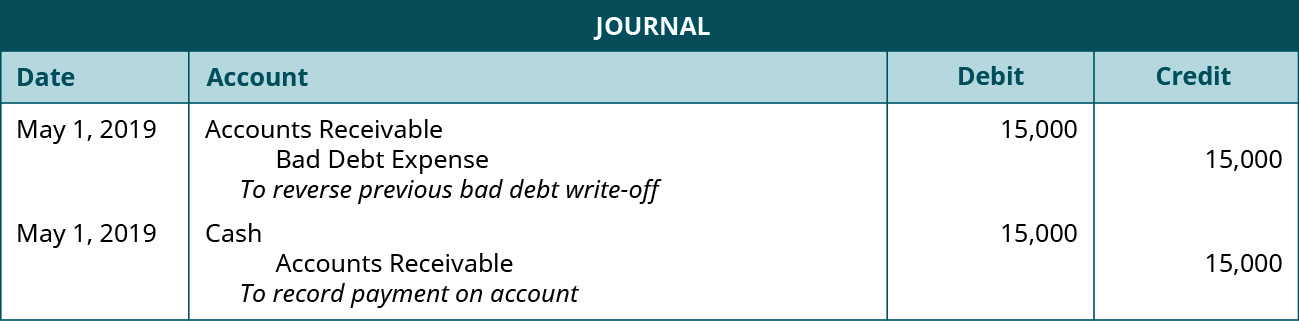

Hire a collections firm to recoup the funds. Contact customers in priority order (largest to smallest) to minimize bad debt. If you have more than $20k in credit card debt americor can help!

The usual procedure is for the fdic to hold a secret auction and the bank’s assets and liabilities are sold to a larger bank. Get a free debt consultation in minutes. In addition, there are other forms of bad debt.

Provide at least the name and address of the original. To sell consumer debt asset portfolios you will need to. Closing the loop by selling bad debt working effectively with collection agency partners.

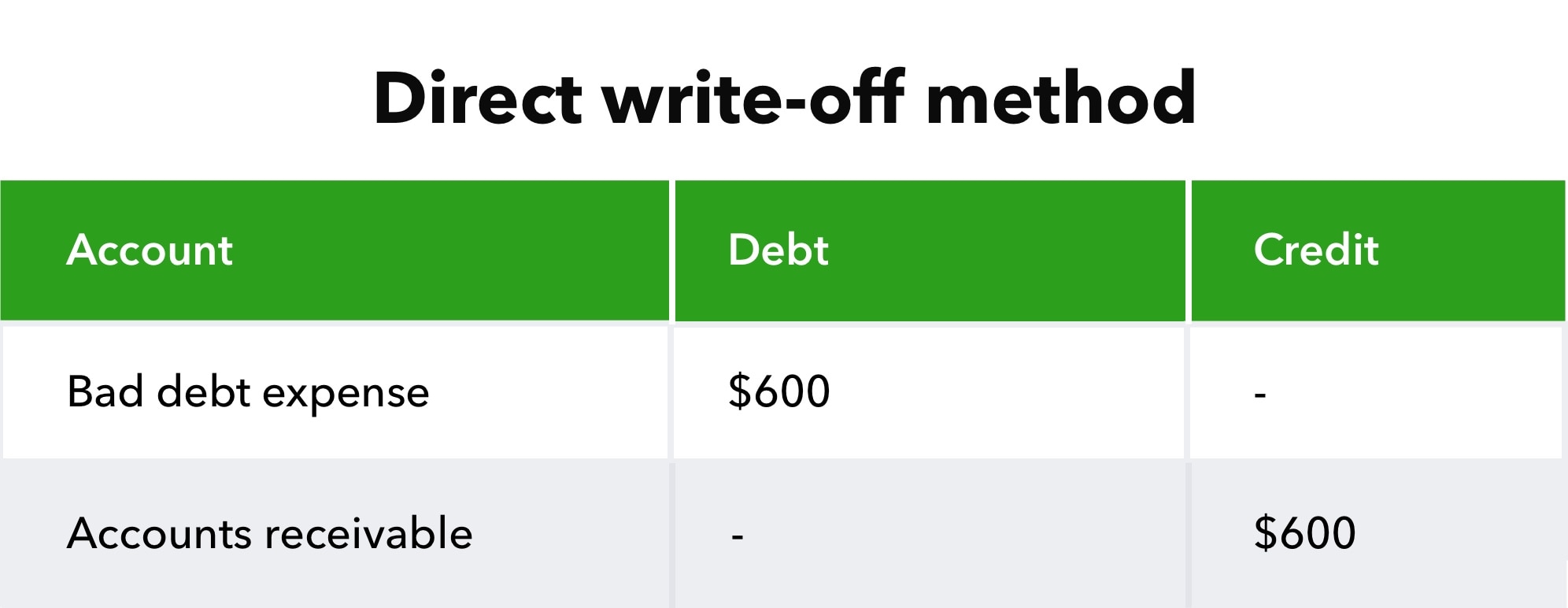

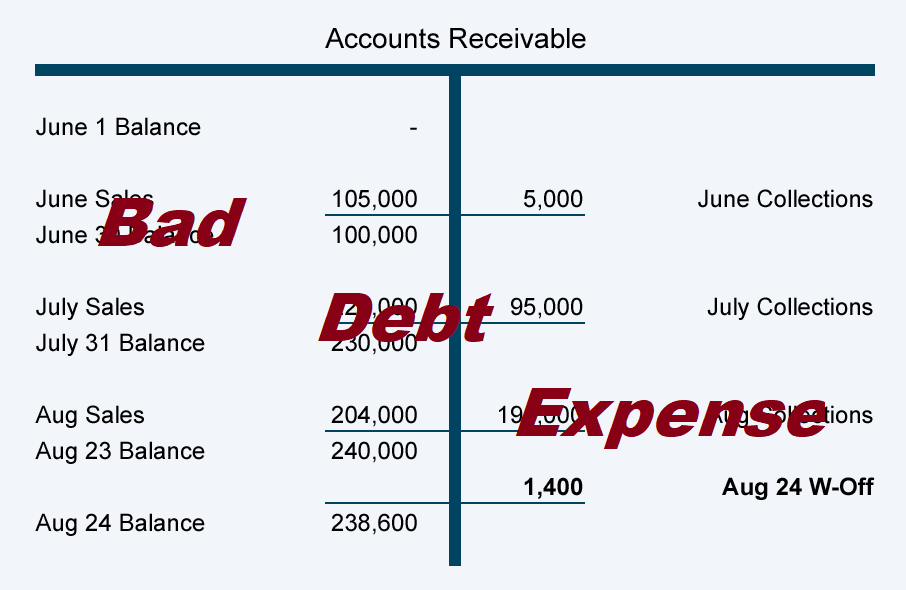

The debt buyer then collects on the. Writing off the debt as a loss. Over the weekend, the fdic will transfer all of the dead bank’s.