One Of The Best Info About How To Fight Tax Increases

One way to lower your property tax is to show that your home is worth less than its assessed value.

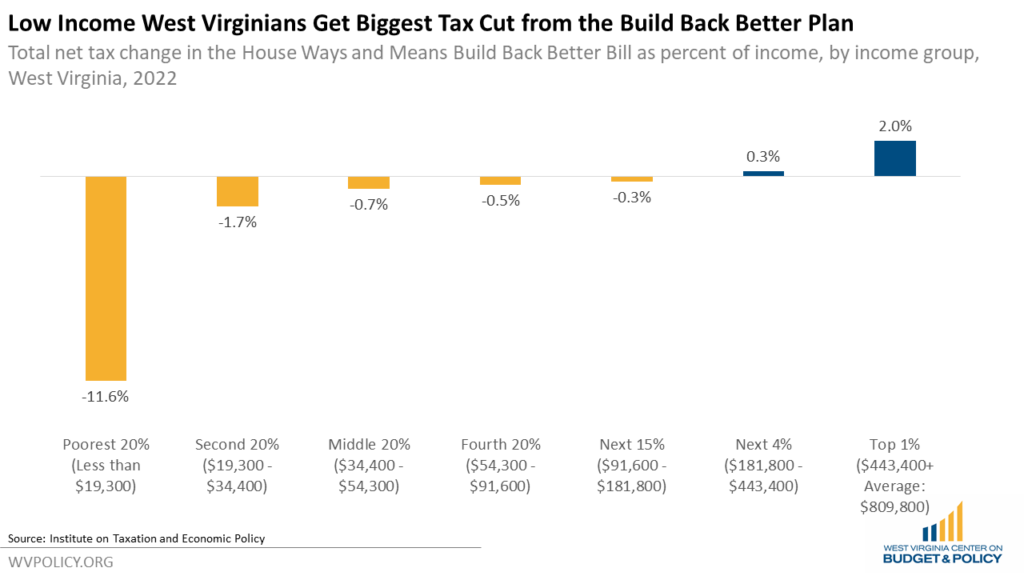

How to fight tax increases. Depending on the value of your home and the local tax rate, a successful appeal can save thousands of dollars. Check your property tax assessor’s website. Under the school finance bill, school property tax rates will be reduced by an average of 8 cents per $100 of a home’s value in 2020 and by 13 cents in 2021.

To avert tax increases and preserve the president’s successful income tax cuts, republicans need to start cutting spending. As soon as you receive your proposed property tax. 1 invest in goods or commodities, not money:

Call the local building and tax. Locate the problem you’ve heard it before: To fight against rising property tax bills, texans have two steps to follow.

Make sure you have your. 2 get a strong support group: Saying you feel your property is overvalued is a waste of time.

How to lower property taxes: Use various tools to get your facts straight: 5 hours agoit also will receive $287,100 from personal property tax relief and $220,572 in per capita grants.

Your city, town or county may offer tax abatement and exemption programs to help you reduce your property taxes. See if you qualify for tax exemptions. Learn the appeals procedure for the county your property is located in.